Wall Street Slumps Real Estate Cools Off

The rise in interest rates are beginning to show the economy is slowing down. Stocks are the most liquid of assets. Stocks and bonds are more immediate in price changes. Real Estate is slower in reaction. Real Estate must be watched to gather trends.

I personally look at the MLS Daily Summary. It lists all the new listings, pending sales, sales, with drawn, cancelled, expired, sold, and most important back on the market.

The MLS Listing indicates a sellers market as home prices stay relatively firm. Sales occur at over list in most of our markets. Price cuts are beginning to mount. We are still in the active season in the Real Estate market. Once we get into June and the sales of April and May close escrow, we will see if a slow down in price or listings occur. It is my observation that the listings are very strong now, I doubt they will slow down. Why, too much money has been placed in remodeling and updating by contractor, speculators and home owners to want or can pull homes off the market.

The Thursday, May 19, 2022, Wall Street journal front page right column had The Stock Market Slump first and the Cool off in home prices next.

Sooner or later the media will come about to see the impact of how higher interest rates will create asset weakness.

The worrisome part of this slow down is in the Subprime Borrowers. They are the first line of first home buyers that are seeing their loan commitment drop and their credit card balances increase due to higher interest rates.

Two more interest rate increase are for certain. It is certain that all forms of debt will see interest rates increase. Along with the debt increase the interest paid on intermediate to short term US Government Bonds will increase. It will be hard to not accept a 5-year US Treasury Bond at 5% or 5.5% versus a buy the bounce in a FAANG stock or Nvida, which so many clients and real estate agents ask my opinion of.

How does a buyer or seller operate in this market?

For the buyer, place offers in 10% under the list, make the offer contingent on financing and appraisal. If the appraisal comes in below list tell your agent to see of the seller will take a modification of purchase price to the appraisal. Get ready for rejections. Sooner or later you will get an acceptance. In this manner your interest rate rise are partially being borne by the seller in a lower sales price.

If it is a MUST BUY, try talking to Homeward or DIVVY to buy the home for cash and allow you buy it back with your financing. i never used them, but found them in an article on Startups.

For the seller; get your agent to get a CMA, comparative market analysis, no more than 3 months and the shortest being the most acceptable. Place the list 10% under the CMA. Do not look to sell at the high price. The seller wins in higher yield on money market accounts to store their proceeds in, and lower prices for the move to a new home.

Remember this, buyers and sellers get hurt in a rising interest rate market. Waiting hurts both! A recession in a inflationary market is called STAGFLATION. It happened in the 70's. It is financially and emotionally painful!

Bear markets in stock will historically last 2 years. That would make the end after or at the next presidential election or the congressional election in November 2022. Inflation is the worst to survive, 27 months on average.

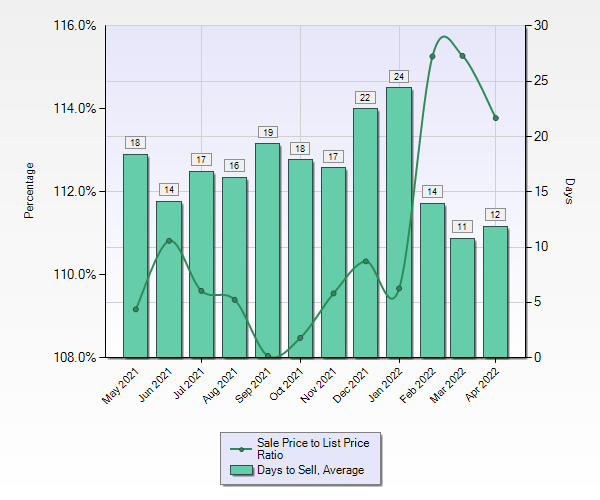

Follow this graph to chart the home market.

Gary McKae

Comments

Post a Comment