Asset price Re-evaluation

The stock market is definitely in a Bear Market, as defined by a 20% correction from past highs. Lower lows and lower highs all create for a trend downward. Interest rates had a big day in the terms of Mortgage Rates this past week. At one point I saw a 6.4% 30 year mortgage offered. 30-year conventional per the local Mercury News were quoted at 5.9%; which is unique to the 30-year jumbo at 5.44%. Whatever the rate, they are up substantially from the past week and the month prior and going back to one year ago. The days of The FED is Your Friend are done. Easy money and frivolous spending is out. There are 75 new listings in the past 7 days, up from 63 a week ago. 23 price cuts and fewer sales and closes as the days and weeks prod by. Agents are sending out emails offering higher commissions to agents representing buyers....as if we are pimps who work for the highest bidder. Agents who prided themselves on numerous listings now are offering wine and cheese parties to promote their listings.

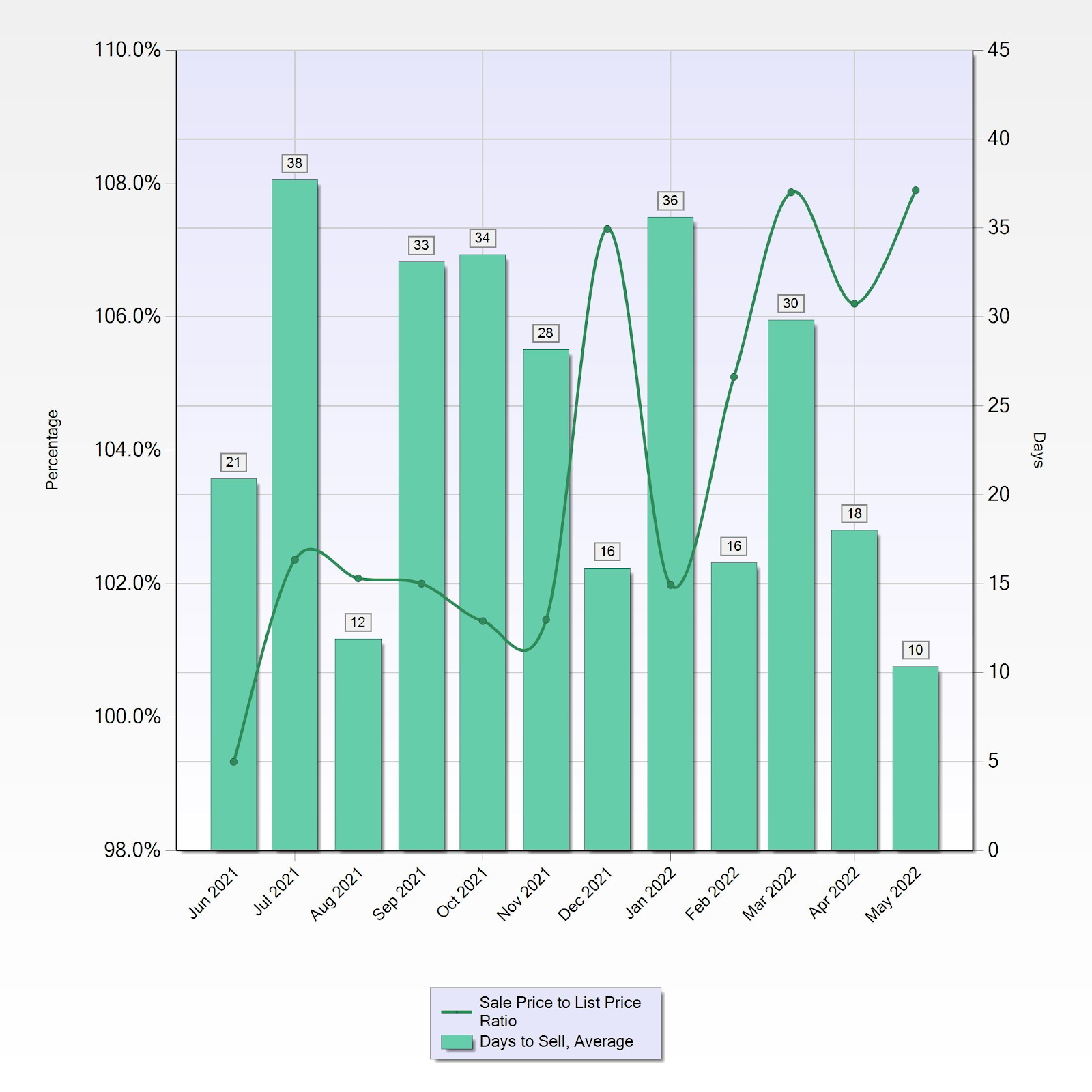

The premiums of list to sales are also declining as with the days on the market increasing. This is usual for the summer. Cancelled, expired and withdrawn listings continue to expand. This is normal for the June forward period. There is one area in which sales to list and days on the market continue to maintain strong interest....East Palo Alto.

Luxury Realtors are now seeking other areas in which the markets remain strong, Redwood City has many agents that once would never take a "Deadwood City" listing are popping up. Woodside, Los Altos, Palo Alto and Menlo Park seem to find the market more favorable to them in /redwood City. All a sign of a softening market.

In the Broker Price Opinion work, there continues to be work by "Fix and Flippers" in the East Menlo Park and East Palo Alto area. Once forgotten rentals that only the destitute would rent are now being stripped remodeled and marketed quickly for reasonable prices. Alas, Home Depot enhancements, but; never the less, a major improvement form the rat infested former home, where abandoned cars sat in the front yard and weeds grew with abandon. The neighbors of these new remodels are now seeing pride in ownership and update and work on their landscaping. A new wave of home ownership is happening. While cheap interest rates created riskless abandon. It did help create a new wave of home ownership.

Broker Price Opinion is now spreading from the "Fix and Flip Market" to the luxury high end market as long time owners are now thinking about downsizing. From Atherton, to Menlo Park Allied Arts, to Los Altos Hills; owners are interested in what their home is worth. All of this should be good for the inventory market. Too long home owners and buyers looked at their home as a FAANG stock. Yes, it is the largest part of an estate, but it is not easily liquidated as shares in common stocks.

Now what about the stock market? Did you know that if Exxon Mobil had remain in the Dow Jones Industrial Average and was not replace by Sales Force. The difference would be Exxon up 75% and Sales Force down 75%. Now look at the other companies that were removed in the hey day of growth and high technology. Wall Street has a way with playing with your pocket book.

My son-in-law says they always come back. Well youngster you weren't here in the 70's and many never came back!

Now is this the 70's of Stagflation and recession. While I read the "experts" tell me that the high interest rates will cause a recession, I still do not see anything else than an asset value re-evaluation. The change in the use of interest rates, the negative interest rate and the creating of money supply by the FED buying Bonds in the after market has created a large reserve of cash in the populace's savings. Most average citizens are not big investors. Yes, they have a 401-K plan and a retirement plan at work; but by-in-large they only play the market. Once burnt they stay out for a long time. So, we will see if the Crypto craze vanishes as quickly as it started; along with MEME stocks.

My energy portfolio has done exceptionally well. The merger acquisition part continues to add profits. Mergers will continue to be the place to go as equity prices decline. A company is worth more to an acquirer than that in the public market so just keep your eyes on mergers. The new place is Biotech. Forget about the ETFs, Tokens, Index plays and anything else created by a kid from Wharton in the back room of an Investment Bank.

In closing for all of you who have expressed your appreciation in this Newsletter or Blog, send me your referral to ad to the list. A Referral is your greatest complement.

Comments

Post a Comment