Wall Street Slumps Real Estate Cools Off

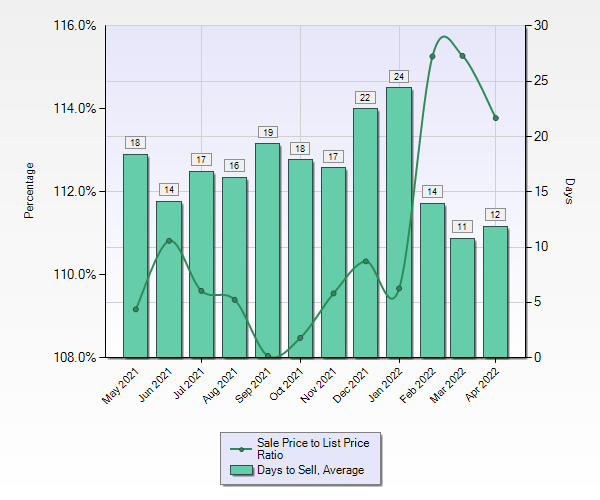

The rise in interest rates are beginning to show the economy is slowing down. Stocks are the most liquid of assets. Stocks and bonds are more immediate in price changes. Real Estate is slower in reaction. Real Estate must be watched to gather trends. I personally look at the MLS Daily Summary. It lists all the new listings, pending sales, sales, with drawn, cancelled, expired, sold, and most important back on the market. The MLS Listing indicates a sellers market as home prices stay relatively firm. Sales occur at over list in most of our markets. Price cuts are beginning to mount. We are still in the active season in the Real Estate market. Once we get into June and the sales of April and May close escrow, we will see if a slow down in price or listings occur. It is my observation that the listings are very strong now, I doubt they will slow down. Why, too much money has been placed in remodeling and updating by contractor, speculators and home owners to want or can pull h