What's Really Happening in the San Mateo & Santa Clara County Housing Market?

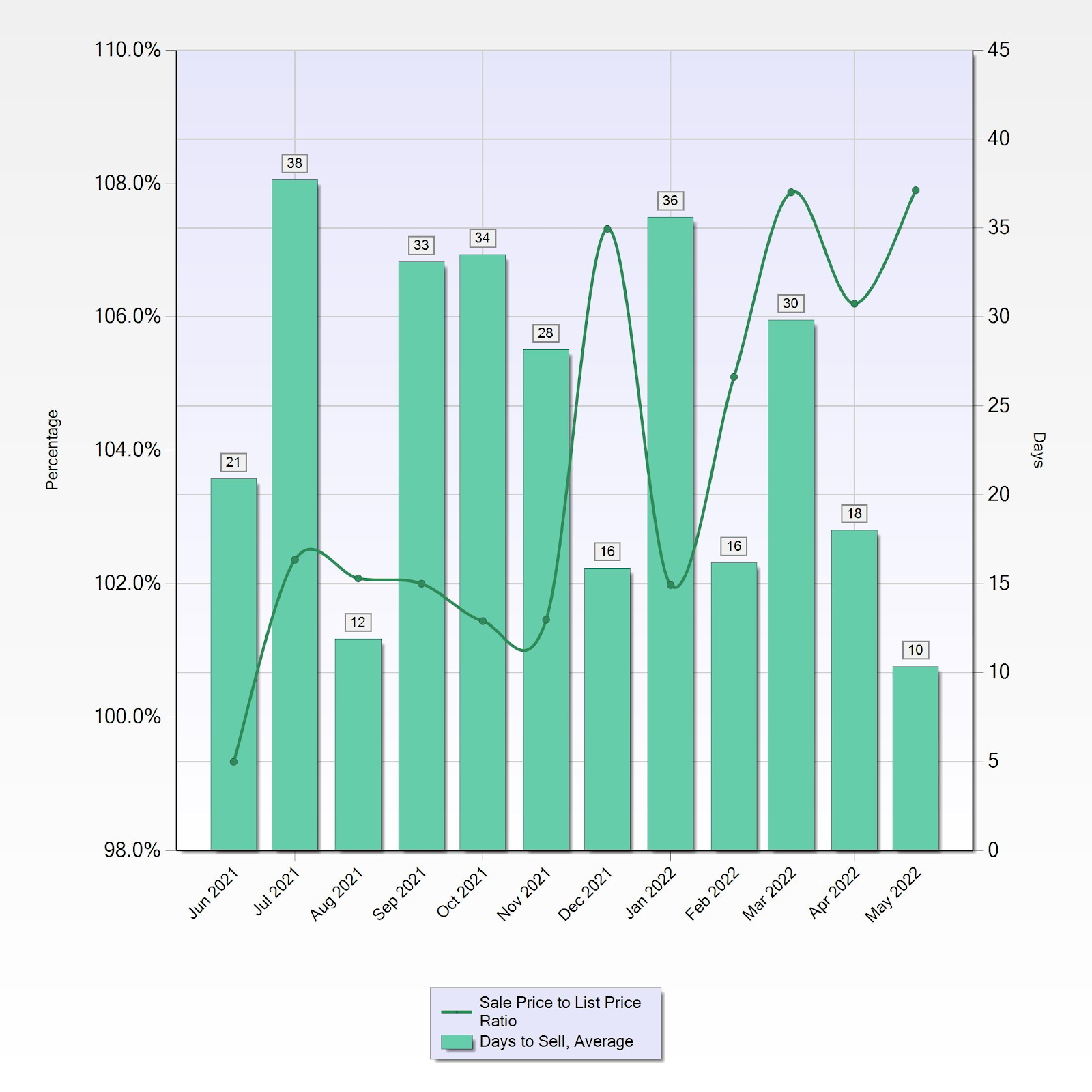

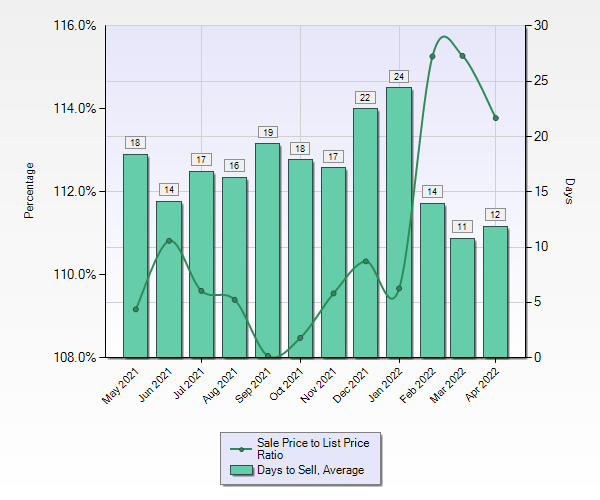

Higher interest rates, Low unemployment, Help Wanted signs, Empty store fronts, are all indicating to the passer by that the economy is confusing. " Residential sales are down substantially on a year-over-year basis, inventory is on the rise, and price reductions are becoming more common." The reader should keep in mind that our real estate market moves differently than the rest of the United States and the rest of the State of California. The "media" which reports real estate is 4-6 weeks behind in their reports. Sort of like listening to a delayed broadcast of a baseball game while watching it live. Sales are definitely down from June of last year some 30%. Last year was also the hottest housing market we have had in the past 12 years. So it is bound to have some pause. Still it appears there was about 5% over biding during the slow down. So things are not that bad. What is really bothersome is the "Feeling" of this market environment. Like